Content

A physical asset could have some remaining value at the end of its useful life, which could be sold for scrap or resale. So, to calculate depreciation, the asset’s salvage value, resale value, or scrap value is subtracted from its original cost. StoneX Financial Ltd (trading as “City Index”) is an execution-only service provider. This material, whether or not it states any opinions, is for general information purposes only and it does not take into account your personal circumstances or objectives. This material has been prepared using the thoughts and opinions of the author and these may change.

GRAY TELEVISION INC MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (form 10-K) – Marketscreener.com

GRAY TELEVISION INC MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (form 10-K).

Posted: Fri, 24 Feb 2023 17:18:07 GMT [source]

All of these can be amortized, mainly by determining how much is spent on them, as their value can be subjective. Thousands of business owners trust Akounto for managing their accounts. Amortization and depreciation are similar concepts but different accounting treatments. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

Amortization and Depreciation Calculations

Updated depreciation studies are usually performed on a regular basis to support ongoing use of the group or composite method. The frequency of the study is a function of the extent of changes since the last study. For example, more frequent or immediate studies may be appropriate in circumstances when a reporting entity experiences a significant and unplanned level of retirements.

Can you amortize and depreciate an asset?

Depreciation. Capital expenses are either amortized or depreciated depending upon the type of asset acquired through the expense. Tangible assets are depreciated over the useful life of the asset whereas intangible assets are amortized.

Also helps the business to forecast the cash requirement and at which year the probable cash outflow should occur. Involved in amortization, whereas, in depreciation, there is a salvage value in most cases.

Key Differences Between Depreciation and Amortization

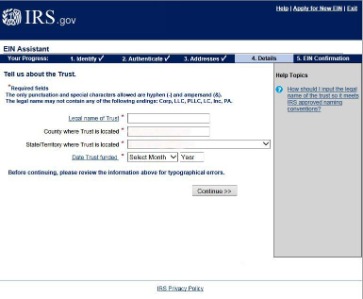

If you have assets to depreciate or amortize, then this form must be added to your tax submission for the year. Such tax forms have instructions on how to fill them out and how to do the necessary calculations. This is similar to the above method but is instead calculated by doubling the rate under the straight-line method early in the asset’s life.

The rule of thumb is that intangible assets are amortized, and tangible assets are depreciated. However, the Generally Accepted Accounting Principles will have guidance on how to categorize different assets. If you’re unsure whether an asset should be amortized or depreciated, you should refer to the guidelines. Most intangible assets don’t have any resale or salvage value, meaning that the amortization is typically the fees required to keep the asset for the business. This can include fees to keep a patent up to date, maintain copyright, or maintain a brand’s image. The straight line method is normally used for amortization, where the same value/ amount is deducted from the opening value of the asset every year. The annual amortization expense is a noncash expenditure that is posted to the income statement.

Site and content preferences

You would also need to adjust for the purchase data in the first year (so if it was purchased in June, you would get approximately half of the first-year deduction). This allows you to spread out the tax benefits instead of taking them all up front. The goal of amortization is to closer align the expense with the income the asset will produce over time. The IRS allows businesses to take several accelerated depreciation deductions for tangible business assets and some improvements. These special options aren’t available for the amortization of intangibles.

Amortization vs. Depreciation: What’s the Difference?

Intangible vs. tangible assets, cause of reduced asset value, applicability, salvage value and journal entries.

To visualize the straight-line Amortization Vs Depreciation method, consider the following example. With this method, the company depreciates the asset by the same amount every year. However, when there are unforeseen or unexpected retirements, a gain or loss should be recognized in earnings. For example, the early retirement of an entire generating station due to storm damage would likely be considered unforeseen or unexpected and would result in the recognition of a loss. This is a big factor when it comes to amortization vs depreciation since only depreciating items need maintenance. For example, a single-use item like a paper cup would have a much steeper depreciation rate than a reusable glass cup.

How Is Depreciation Handled in Accrual Accounting?

An amortization schedule is used to calculate a series of loan payments of both the principal and interest in each payment as in the case of a mortgage. So, the word amortization is used in both accounting and in lending with completely different definitions. The company mostly use the straight-line method for recognizing the amortization expense. Because both depreciation and amortization are using the straight-line method, the two items can be combined into a single figure in the filing. For example, an architectural firm might purchase a high-end 3D printer for generating detailed, scale models. They determine that the machine is capable of producing 800,000 3D-printed pieces over its lifetime.

- Keep in mind that an expense means money out of your pocket, no matter the reason.

- The company mostly use the straight-line method for recognizing the amortization expense.

- At extreme levels of production, this relationship succumbs to the time element, and the productive asset is considered to have a minimum and maximum economic useful life in years, regardless of usage.

- The IRS defines depreciation as an annual allowance for the deterioration and obsolescence of property over time.

- This applies more obviously to tangible assets that are prone to wear and tear.

- However the difference is that amortization applies to intangible assets, while depreciation applies to tangible assets, because of this, different methods of calculation can be used.

73% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. CFD and Forex Trading are leveraged products and your capital is at risk. Please ensure you fully understand the risks involved by reading our full risk warning.

Businesses will determine a rough estimate of both the asset’s useful life and its yearly decline when logging depreciation, but these estimations change each accounting period. Amortisation is a method employed by businesses to log the decline in an asset’s value over its expected lifetime.

While your https://intuit-payroll.org/ possessions will likely lose value over time—aka depreciate—most pieces still have some “salvage value” if you want to sell them. An asset’s salvage value is its worth after it depreciates and is no longer functional. You can use a depreciation method called the straight-line method to find this. You should keep an eye on both amortization and depreciation because although they are “non-cash” expenses they can cost you a lot of your earnings.